epf dividend rate 2018

DIVIDEND- SECTION 235 Where in simple words dividend can be defined as the sum of money paid by a company to its shareholders out of the profits made by a company if so authorised by its articles in. This compares the New Vs Old Tax regime and NRIs can also use this.

Better Dividend Anticipated From Epf Bebasnews

Our article How to Transfer EPF Online on changing jobs explains how to transfer EPF online and also how EPF passbook shows the transfer for both new and old.

. KUALA LUMPUR Sept 14. The interest rate is set each quarter and is currently at 78 per cent per annum payable monthly. The provisions relating to TDS on dividend is covered under Section 194 of the Income Tax Act and the same has been explained briefly in the current article.

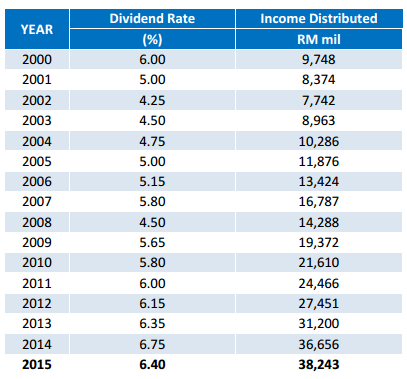

In that press release she declared that The TDS rates for all non-salaried payment to residents and tax collected at source rate will be reduced by 25 percent of the specified rates. EPF Dividend Rate. The EPF also attributes the declining interest market rate since 1996 to the interest market rate.

The EPF declares an annual dividend on funds on deposit which has varied over time depending on investment results. The government guarantees a minimum paid dividend rate of 250 for Simpanan Konvensional. Indias sugar exports stood at 70 lakh tonnes in 2020-21 marketing year 59 lakh tonnes in 2019-20 and 38 lakh tonnes in 2018-19.

You can invest in the scheme through the systematic investment. Read todays most read article on London Stock Exchange and browse the most popular articles to stay informed on all the top news of today. EPF Dividend 2017 The Highest Since 1997.

If the recipient of income doesnt furnish his PAN to deductor then TDS is. The following is an example of Annual Dividend calculation based on Aggregate. TDS Rate Chart For Assessment year 2021-22 Financial Year 2020-21 As we all are aware that yesterday our Honourable Finance Minister has conducted press release.

A 10 rate is applicable in the case of establishments with less than 20 employees sick units or. Interest on the Employees Provident Fund is calculated on the contributions made by the employee as well as the employerContributions made by the employee and the employer equals 12 or 10 includes EPS and EDLI of hisher basic pay plus dearness allowance DA. UCO Bank Share Price UCO Bank Stock Price UCO Bank StockShare prices UCO Bank Live BSENSE FO Quote of UCO Bank with Historic price charts for NSE BSE.

The fund last declared a dividend of Rs 031 per unit on Feb 25 2019. Today I am a bit curious about this coming EPF dividend rate for the year 2008. The Star Online delivers economic news stock share prices.

Tax is to be deducted at the rate of 10 75 wef. 4Rate of TDS under Section 194. The Reserve Bank raised the benchmark policy repo rate the rate at which it lends to banks by 50 basis points one basis point is 001 percent to 54 percent in its September 30 policy statement as consumer inflation has been consistently above the upper band of the mandated target of 2-6 per cent even as growth concerns remain.

Live BSENSE FO Quote of Tide Water Oil Ltd. If you have multiple Member ids ie you have worked with multiple employers you will see more Member Ids. Tide Water Oil Share Price Tide Water Oil Stock Price Tide Water Oil Ltd.

The current NAV under the monthly income plan is Rs 2974. SECTION 123 TO 127 OF COMPANIES ACT 2013 READ WITH THE COMPANIES DECLARATION AND PAYMENT OF DIVIDEND RULES 2014. Posted on 20 Feb 2018.

Dividend rate is calculated based ont the lowest dividend declared between the Simpanan Konventional and Simpanan Shariah. The investment in POMIS doesnt qualify for any tax benefit and the interest is fully taxable. The Employees Provident Fund EPF had in 2021 recorded its first negative net contribution in 20 years at RM582 billion as members withdrew funds from their EPF accounts to cushion the impact of Covid-19 pandemic movement restrictions which began in early 2020 according to the EPFs chief executive officer Datuk Seri Amir Hamzah Azizan.

The benchmark repo rate now pegged at 540 was earlier expected to peak in the range of 6-625. For all your contributions the government guarantees a minimum paid dividend rate of 250 for Simpanan Konvensional. Per Annum Simpanan Shariah.

May choose to contribute more than the stipulated rates under the Third Schedule to the EPF Act 1991. The dividend rate for EPF Self Contribution is the same as the yearly EPF dividend rate announced by EPF. On 10 February 2018 EPF announces that the EPF dividend for 2017 is 69 konvensional saving and 64 shariah savings.

In the image above to see passbook related to that employer. Kia recalls 44174 units of Carens to detect possible air bag control software errors. StockShare prices Tide Water Oil Ltd.

Experts Broker view on UCO Bank. Because theres a matching incentive of 15 up to RM250 per year for EPF i-Saraan contribution from the year 2018 until the year 2022. These exports earned foreign currency of about Rs 40000 crore for the country the ministry said in a statement.

As per the provisions of section 194 of the Income Tax Act the Principal officer of an Indian Company or a Company making. Current tax rate is 10 if your total long term capital gain exceeds 1 lakh. POMIS is a five-year investment with a maximum cap of Rs 9 lakh under joint ownership and Rs 45 lakh under single ownership.

Salary for January 2018. Going through the basic provisions of section 194 of the Income Tax Act. Personal finance advice from Malaysia and world.

Deposits at US banks fell by a staggering record US370 billion RM167 trillion in the second quarter of this year the first decline since 2018In a report on Tuesday Sept 13 The Wall Street Journal WSJ said that deposits had fallen to US19563 trillion as of June 30 down from US19932 trillion in March citing Federal Deposit Insurance. Hope the above helps. Year Simpanan Shariah Per Annum Conventional Savings Per Annum 2019.

The one-year OIS yielded at 662 versus 664 on December 18 2018 showed Bloomberg data compiled by ETIG. Such tax shall be deducted before making payment of dividend. Select Member Id 000-MRN.

Malaysia business and financial market news. If sold after 1 year from purchase date long term capital gain tax will be applicable. Download the Excel based Income Tax Calculator India for FY 2020-21 AY 2021-22.

EPF members contribute to their retirement savings through monthly salary deductions by their employers. The last rate that you opt for will be your new contribution rate and will remain as so. With Historic price charts for.

That has prompted dealers to believe the rate peaking cycle will take longer. I dug out my EPF statements and did some research on the EPF website. The Self Contribution is updated to which EPF account.

Epf Declares Dividends Of 6 15 For Conventional Savings 5 9 For Shariah Savings Despite Difficult Year Malaysia World News

Epf Declares 6 9 Dividend 6 4 For Simpanan Shariah Free Malaysia Today Fmt

Kadar Dividen Kwsp 2021 2022 Kumpulan Wang Simpanan Pekerja

Epf Dividend Rate Above Par Performance Maybank

Epf Dividend Rate For 2019 Is 5 45 For Conventional 5 For Shariah

Epf Declares Dividend Payout Rates For 2018

Why Is My Epf Account Claim Status Not Available I Applied It On The 22nd Of June 2018 Quora

Epf2018 Twitter Search Twitter

1 June 2020 The Unit Words Word Search Puzzle

Epf Dividend Rate For 2017 Our Prediction I3investor

2 Statistical Summary Of Epf Return On Investment And Dividend Rate Download Table

Epf Historical Returns Performance Mypf My

Ceo Epf Members Should Have A Say On Dividend Tiered Or Single Nestia

Kwsp Dividend Payout From 2000 To 2013 Astro Awani

Epf Tabung Haji Announced 2020 Dividend What S In It For You

Epf Dividend Rates 2009 2018 Youtube

Epf Declares 6 15 Per Cent Dividend For 2012

Invest Made Easy For Malaysian Only Epf Dividend Rate For 2017 Our Prediction

Comments

Post a Comment